Ethereum and the L2 Offsprings

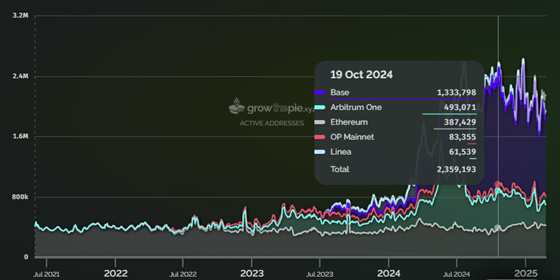

Ethereum, the world's second-largest blockchain, has long struggled with scalability. As transaction fees on the network soared, Layer-2 (L2) solutions such as Arbitrum, Optimism, and more recently Base, sprung up to offer users lower costs and faster transactions. These once fledging L2s have matured and risen meteorically in the last two years. Millions of user wallets have migrated over to L2s, congestion and transaction fees on Ethereum’s Mainnet plummeted, and throughput has gained many fold. Active addresses today on Ethereum account for just 20% of the broader network. What does this mean for Ethereum?

Total active addresses on Ethereum L2’s vs Ethereum (source: growthepie.xyz)

“The child is grown; the dream is gone.” – Pink Floyd

While L2s bring efficiency, critics argue that they do so at Ethereum’s expense. On Ethereum, most of the transaction fees are used to reward validators, who secure the blockchain, while a small portion is burned as per the previously approved EIP-1559 mechanism, thereby marginally deflating the overall ETH token supply. With activity moving to L2s, Ethereum’s revenue stream is being disrupted, both reducing incentives for network validators and disrupting the burn mechanism. The Dencun upgrade in March 2024 (briefly discussed here), allowed for improved scalability with reduced fees, and paved the way for L2s. The effect has led to L2s retaining most of the fees they collect, remitting only a fraction to Ethereum. For example, over the last 90 days, Base and Arbitrum have remitted only 10% and 23%, respectively, of their collected transaction fees to Ethereum.

Transaction costs have plummeted since the Dencun upgrade (source: growthepie.xyz)

… as have fees paid to Ethereum (source: growthepie.xyz)

Even as transactions count has roughly quadrupled (source: growthepie.xyz)

Meanwhile, ETH token supply has turned slightly inflationary (source: Ultrasound.money)

The proliferation of L2 solutions has also fragmented the Ethereum ecosystem, with liquidity, users, and developers dispersed across multiple networks. Moving assets between rollups remains cumbersome and subject to smart contract risks. This splintering could potentially weaken Ethereum’s once-cohesive network effect. Tokenomics is further exacerbated by many L2s issuing their own tokens, such as Arbitrum’s ARB and Optimism’s OP. If these tokens become the de facto medium of exchange within their respective ecosystems, ETH’s utility as the primary gas token could further diminish. Promises of Ethereum working synergistically with its L2s seem to have dissipated.

Existential, or Just a Mid-Life Crisis?

Aside from L2s, Ethereum faces stiff competition from alternative high-performance Layer 1 (L1) blockchains such as Solana and Binance Smart Chain. Over the last several months, this has invited much introspection from within and outside the Ethereum community.

Active users, by major chains (source: Token Terminal)

Listeners to Bankless and Unchained podcasts would undoubtedly recognize the ongoing debates about the future of Ethereum. With titles like “Can Ethereum Compete with Bitcoin, Solana & Celestia?” and “2025 Will Be a Year of Crypto Competition. Can Ethereum Make a Comeback?”, Ethereum is seemingly on its back foot. With hindsight, it is perhaps unsurprising that ETH price is down about 45% relative to BTC since the launch of its spot ETFs in the US in mid-July 2024.

None of this is lost on the Ethereum Foundation (EF). Indeed, Vitalik Buterin tweeted on X in mid-January the EF’s updated goals to improve technical expertise, improve transparency and communications, all the while remaining decentralized and politically neutral. The EF reorganization has been in progress for about a year and just recently, we witnessed a leadership change with Aya Miyaguchi stepping away from her Executive Director role to be the foundation’s President.

Early Growth Stages

Proponents, however, contend that L2s are not a drain but a necessity, as they ensure Ethereum’s longevity by solving its most pressing issue - scalability. By moving transactions off L1 while still settling on Ethereum, L2s have increased the network’s throughput from a paltry 15 transactions per second (TPS) to about 200 TPS now, and potentially thousands of TPS in the future. This ensures that Ethereum can accommodate mainstream applications without sacrificing decentralization. Furthermore, the modular blockchain thesis suggests that Ethereum’s best role is as a robust settlement layer, securing the broader ecosystem. In this model, L2s complement rather than compete with Ethereum.

Transactions per second on L2 improves by a factor of 15 (source: L2Beat.com)

Ethereum’s community is already exploring mechanisms to ensure L2s contribute back to L1’s sustainability. Proposals such as mandatory fee-sharing or requiring L2 sequencers to stake ETH could restore some of the lost economic value while preserving the efficiency benefits of rollups. By improving scalability and lowering fees, L2s have unlocked applications that were previously impractical due to high gas costs. Examples include web3 gaming (e.g., Gods Unchained on Immutable X), social networks (like Friend.Tech on Base), and microtransactions (e.g., payments between AI agents on Base).

We, at Firinne Capital, are of the strong opinion that we are still only seeing the early stages of the blockchain and Layer 2 development. Collectively, the DeFi/CeFi, gaming, and other transactions that currently occur across today’s networks, all pale in comparison to what is yet to come.

The traditional finance industry took close to 7 years to migrate from a T+2 settlement in September 2017 to T+1 in May 2024, at estimated costs in the tens of billions of dollars for implementation and compliance. Yet, this was worthwhile to allow for improved collateral management, and for reducing risks and borrow costs. How much more time and costs will it take to move to T0? Doing more of the same – relying on centralized agents, guarding privately held databases, hiring more people or deploying AI agents to reconcile cross-party transactions – will cost multiples of what was spent to achieve T+1. Meanwhile, we currently have available a more cost-effective solution. Blockchain technology offers, right now, T0 or near instantaneous settlement, that is up and running 24/7/365. When we talk about merging Web 3 with real world finance and other applications, from tokenized RWAs to decentralized physical infrastructure networks (DePIN), this is what we will need.

The competition, or “co-opetition”, between L1 and L2s, is part of the technological and financial learning process. It is a feature of the iterative journey on which technology is developed, product-market fit is tested, and business models are made, thrashed, and re-created. The dream of a performant blockchain technology that properly rewards its economically productive participants remains alive and well.