Consider Fat Tails for Setting Guardrails

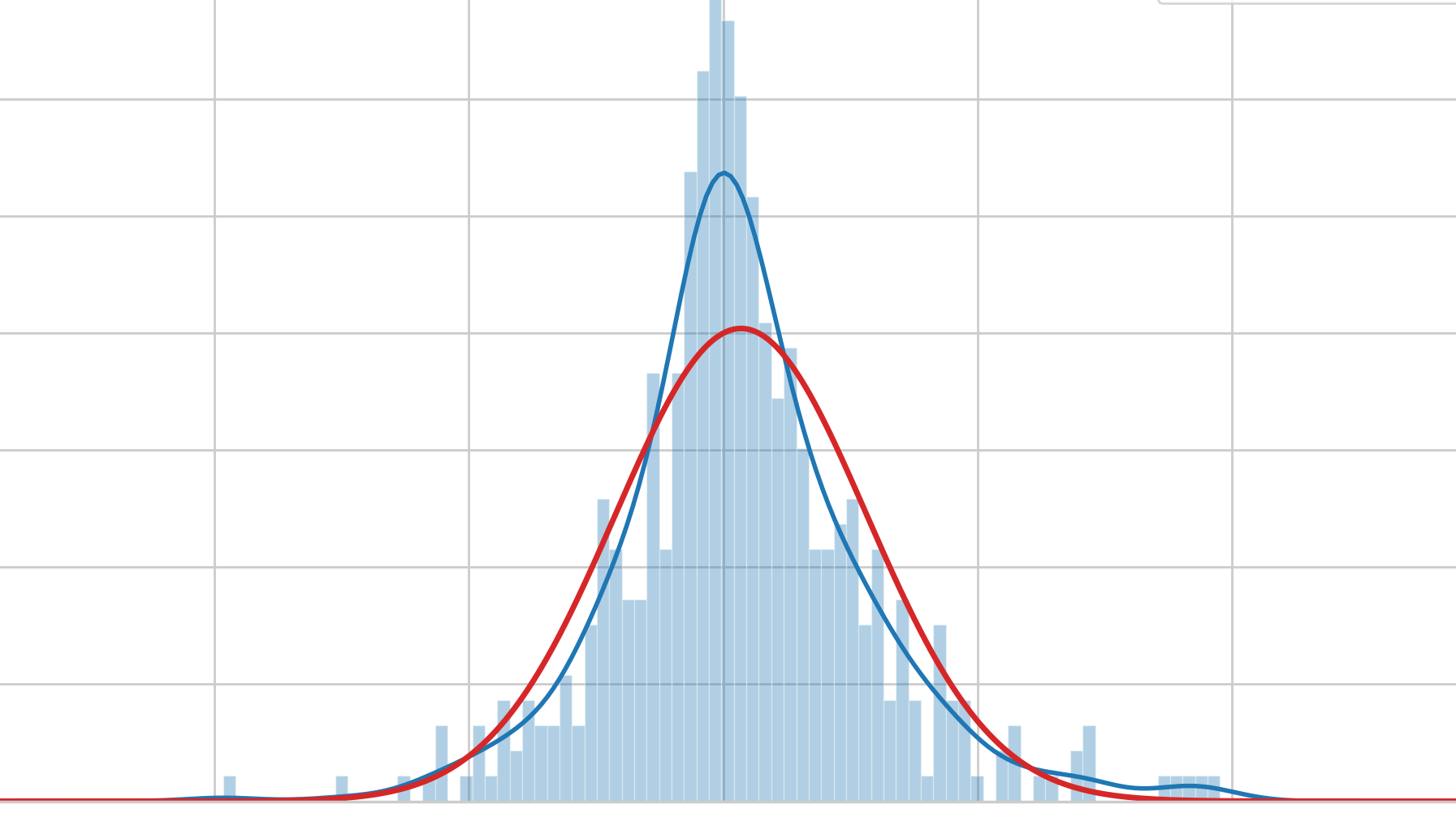

After a soft January, the crypto markets sold off sharply in the first week of February. BTC dropped to a low of $62,822 February 5 (a 50% drop from its October 2025 high of $126,080) before recovering to around $70,000. Many commentators have noted that this is one of the rare multi-standard deviation events, but empirical evidence suggests that oversized negative and positive returns occur more often than what a simple standard deviation metric would suggest. This has implications for portfolio positioning and holding horizons.

It was the best of times …

“It was the best of times; it was the worst of times.” Bitcoin and Ether traded at all-time highs in October yet had one of the worst Q4s on record. April saw a historic drop in the global markets, yet crypto finished the month positive. The price of bitcoin moved more this year than ever, to go essentially nowhere. And we saw significant legislative and regulatory progress in the US but even with all that, sentiment towards year end has never been poorer. What a paradoxical year was 2025.

Know Yourself

“Know your enemy and know yourself; in one hundred battles you will never be in peril” – Sun Tzu, Art of War

November’s market volatility has left many investors battle weary. The Bitwise 10 Large Cap Crypto Index pulled back 18% in November, and close to -6% YTD. 2025 was supposed to be the year of tailwinds – supportive new US administration, favorable legislation, institutional adoption, tokenization of RWAs. If these factors haven’t been driving the market, then what have?

Winds of Change

“The future's in the air, I can feel it everywhere, I'm blowing with the wind of change” - Scorpions, 1990

That was how the cryptoasset community felt after the US elections in November 2024. With a Republican president and legislators assuming office, years of regulation by enforcement and Operation Chokepoint 2.0 were about to be lifted. Fast forward a year later to November 2025, and we see a new wave of Democratic mayors and governors being ushered into office after the elections. In the evening, as the election polls were nearing their close, BTC dropped briefly below $100,000, over -7% on the day. Expectations are shifting.

Walled Gardens 2.0

Through September and early October, macroeconomic news has captured investor attention. While BTC posted a +5% gain in September, market volatility has increased in light of the US government shutdown now expected by Polymarket to last over 30 days, creeping unemployment without having any official data to verify, and gold prices reaching over $4,000 indicating a higher level of market stress. Investor attention was further drawn to US President Trump’s announcement of new tariffs on China and the subsequent crypto-market deleveraging that ensued. One can be forgiven for not noticing that through the summer of 2025, Silicon Valley quietly redrew the map of finance.

The Fed, The President, and The Stablecoins

As US President Trump becomes increasing vocal in his desire to replace the Fed Chair Jerome Powell and data released in August proved the US economy to be on a weaker footing, expectations rose for a rate cut in September. Indeed, on September 17, the Fed delivered with a 25 bps rate cut, dropping the target range to 4%-4.25%. But if lower rates stimulate a risk asset like BTC, how do we explain BTC posting a -6.49% drop in August? Are the markets afraid of the Fed losing its independence leading to rising inflation and rising long-term rates, upon which risk assets are priced?

America's Crypto Manifest

It seems that Wall Street is about to get a blockchain makeover. The U.S. has embarked on a journey to cement its dominance in digital assets—one that could fundamentally reshape how financial markets operate. At stake is nothing less than America's position as the world's financial capital, and the early signs suggest this is no minor regulatory adjustment but rather complete embrace of crypto's revolutionary potential.

Summer of Institutional Adoption

As we approach the summer months, a lackluster crypto market in June may suggest that cryptoasset denizens are away on travel or at the beach. Nothing could be further away from the truth. Stablecoin legislation progressing through the US Senate, corporate treasuries adding bitcoin and other tokens, and real-world assets (RWAs) accumulating on-chain are all indicators that adoption has been anything but lethargic.

The Age of the Hypercorn

Long, long ago in ancient India, there lived a wise man—or so the apocryphal tale of chess begins. As recognition for his ingenuity in creating this captivating game, the king, feeling generous, offered him any reward he desired. The wise man considered briefly and humbly asked for but a single grain of rice on the first square of the chessboard, two grains on the second … so on and so on, doubling each time until the final, 64th square. The king, amused by the seemingly modest request, readily agreed. One can vividly imagine at precisely which square the king's amused smile began to falter …

Tariff Thy Neighbor

President Trump announced his much-awaited tariff policies after the US market hours on Wednesday April 2, Liberation Day. With investors already jittery from the previous on-again, off-again tariff pronouncements, it had the effect of releasing a trampling bear onto the markets – cryptoassets and equities alike.

Attention Deficit

The ebullience in the digital assets market from the November 2024 US elections has given way to profit taking and navel gazing. BTC peaked at just around $109k in mid-January but is currently struggling to get back to its six-figure status. Ethereum, the OG of smart contracts, even has many of its long-term HODLers questioning if its original visionaries have lost their way. Then there’s the long tail of over 17,000 other tokens listed on coingecko.com. How should we make sense of all of this?

Crypto Comes in From the Cold

If there is no such thing as a dull year in crypto, then 2024 certainly was no exception. It was another year of strong performance for Firinne Capital but also another year of many dramatic twists and turns. It was the year which finally saw bitcoin cross the much anticipated 100K mark, a US presidential candidate taking time out of his campaign to market his own NFT collection, and a crypto based prediction market “out predicting” all the media experts and correctly forecasting a Trump victory.

Bangkok Meets Ethereum: My DEVCON 7 Experience

Firinne’s Victor Li traveled to Thailand last month to attend DEVCON. In his words, “Few events capture the evolving ethos of the blockchain world quite like DEVCON … DEVCON 7 offered more than technical discussions; it was a showcase of the Ethereum ecosystem’s ambition to redefine trust, security, and decentralization.”

A Step Change

The US November 5 election was a step change in many ways, not the least of which for the cryptoasset market and ecosystem. With a decisive majority of the popular and electoral votes, Donald Trump will resume his second term as the 47th President of the United States. Along with Republican control of the Senate and the House, cryptoasset denizens are expecting sweeping support in the form of clearer and friendlier regulations, broader awareness, and speedier adoption by the general populace. Adding to this, the Federal Reserve lowered benchmark rates by 25 bps on November 7. It is no surprise that we are seeing expectations and prices running hot.

Bulls and Bears Face Off

The approval and launch of Ethereum spot ETFs in the US in the second half of July was a major milestone for the broad adoption of digital assets. The volatility that ensued a week later in early August was a reminder that crypto markets trade 24/7/365 and constantly price in new information. Not paying attention is a source of risk and missed opportunities.

Crypto’s Dog Days of Summer

The “dog days of summer" refers to the summer months in the Northern Hemisphere, characterized by hot temperatures, inactivity, and was previously associated with misfortune, according to the Old Farmer’s Almanac. That pretty much sums up the digital assets price action over June. But one doesn’t have to look too far beyond prices to realize that the ecosystem has been anything but inactive and unfortunate.

Reflecting for a moment on ourselves at Firinne Capital, we are thrilled and honored to announce that we won the Hedgeweek’s Performance of the Year – Directional Fund (1+ Year) award.

Celebrating Two Years of a Crypto Odyssey

If it's true that volatility can be thought of as a proxy for time, then it’s no wonder why two years in crypto feels like a decade in traditional finance! Since we began our journey, launching the Firinne Liquid Digital Assets Fund in June 2022, we’ve weathered a complete market cycle – from exuberance to despair, to renewed optimism, and finally, a return to growth.

BTC Halving – Half the Rewards but Much More in Return

The Bitcoin Halving occurred quietly on a Friday night, April19, 8:09 pm Eastern time, when most were out unwinding from their workweek, at block 840,000. Programmatically, miners’ reward for securing a block on the blockchain dropped by a half to 3.125 BTC. Eventually, this reward will drop to 0 as the BTC supply asymptotically reaches a cap of 21 million. But declining rewards obscure the richness of the development around the Bitcoin blockchain.

ETH Unlikely a Security

“March comes in like a lion, out like a lamb” is often used to refer to the passage from winter to spring in the northern hemispheres, but the same can be said of the cryptoasset market this past month. One can blame it on lower inflows to spot Bitcoin ETFs in the second half of March or lower expectations for rate cuts by the US Fed for 2024, but much can be placed on the speculation that the US SEC is trying to classify ETH as a security. How this plays out for the second largest Layer 1 will have repercussions for the cryptoasset industry and for many investment portfolios including ours.

Hedgeweek Global Digital Assets Awards 2024!

We’re delighted to share that Firinne Capital has been shortlisted for awards in five categories in the Hedgeweek Global Digital Assets Awards 2024!