Introducing Firinne Liquid Digital Assets Fund

TL;DR

Eager to capture the spectacular returns generated by the nascent Digital Assets space, investors have been happy to over pay for passive exposure and market beta.

Firinne Capital’s Liquid Digital Assets Fund (FLDA) offers active exposure to large and mid cap digital assets, including the little explored high risk/high opportunity space beyond the top 10 digital assets by market cap.

Incorporating the NASDAQ Crypto Index as a market benchmark, our investor friendly fee structure does not charge investors performance fees on market appreciation.

Our investment philosophy strongly adheres to the core tenets of Digital Assets world – decentralization and disintermediation. Our strategy combines fundamental analysis of projects with best-in-class quantitative data analytics to assess the quality of assets.

Highly inefficient, retail dominated and fraught with unique risks, the digital assets markets present a compelling case for Active Management. Our investment managers are “crypto-natives” with several decades of combined experience in traditional markets and are thus well placed to guide investors through this new unexplored world.

Bitcoin has been the best performing asset of the decade bar none. For those of us who have followed the fortunes of bitcoin from the early days it has been an incredible journey. Following that well-trodden path of all truly revolutionary ideas, we’ve watched bitcoin trace the arc from obscurity, to ridicule, to skepticism, to ‘well-it-was-obvious-all-along’ legitimacy. What started as a fiendishly clever curiosity shared on an esoteric anti-authoritarian cryptography mailing list has now developed into a legitimate emerging asset class in its own right, discussed in boardrooms of banks and pension funds throughout the world. For professional investors, these digital assets are now no longer something which can conveniently be ignored, clients are expecting their managers to be informed on this new asset class, and, at the very least, be in a position to voice an opinion on the subject.

10 years of asset class performance. Source: Interactive Brokers, coingecko.com

For the few funds which existed since the early days of the crypto gold rush, the only thing more outrageous than the returns generated for their investors were perhaps the fees they managed to charge them! Operating at the fringes of finance, in the absence of ETFs, functioning derivatives markets or passive alternatives, under the ever-present spectre of regulatory ambiguity and beset with custody issues – many of these funds could perhaps argue that charging 20% performance fees, for effectively doing little more than operating a Bitcoin wallet for clients, was justified. Such was the fervor surrounding crypto, that exposure at any cost was sought out, and these funds with the confidence, agility and expertise were waiting and more than willing to meet that demand. We don’t fault the early funds of the day for catering to that appetite and charging whatever fees the market would bear for largely passive investment. However, we do believe that as the digital assets space has matured, the time has come too for asset managers to now evolve and offer better value actively managed alternatives to the growing list of passive choices.

In the earliest days following the birth of digital assets, having the wherewithal to just show up to the party was alpha enough by itself. But as the space has accelerated, today the pace of innovation is such that a month in the world of digital assets sees more innovation than years in traditional finance – and the case for true active management is more compelling than ever. In the years to come, we predict that digital assets investing will come to more closely resemble that of traditional investing, however right now we are still very much on the frontier – where both opportunities and threats abound. Never before has there existed a market with potential returns on the scale of venture capital and the depth and liquidity of public markets. Here, choosing the right manager could mean the difference between returns multiples over the market or a complete loss of capital. Hence, finding that rare breed of manager with both the discipline and prudence characteristic of traditional money managers and the boldness and vision of “crypto-native” investors is key. Equally important, in the rush to gain exposure to this rapidly growing asset class, the investor must be careful to select a manager with a fair fee structure - ensuring that they are not being charged performance fees simply because the entire market went up!

The importance of fee structure

With the goals of creating the most investor friendly fund on the market, offering broad market exposure to digital assets and helmed by experienced traditional finance managers and proven digital assets investors – Firinne Capital has created the Firinne Liquid Digital Assets (FLDA) Fund. At the time of writing, to the best of our knowledge, Firinne Capital is the first fund to offer actively managed exposure to the digital assets markets - without charging performance fees for market beta. Our Liquid Digital Assets fund provides active exposure to a variety of digital assets with fees charged only on performance above that of the NASDAQ crypto index, meaning that our fees are amongst the most investor-friendly on the market - and by a considerable distance. Our choice of the NASDAQ crypto index as a benchmark was an obvious one as it offers broad exposure to the digital assets space with coverage of ~60% of the total market capitalization of the entire space from a highly reputable provider. Since assets in the index are held at approximately market weight, the NASDAQ crypto index serves as an effective benchmark on the digital assets space as a whole.

Top: Value generated by different fee structures. Bottom: Breakdown of the fee discrepancy. The effect of early fee extract by the competitor compounds over time to dramatic effect.

To see just how dramatic an impact a fund’s fee structure can have on value generated for an investor, let’s compare the value generated and extracted by two competing funds; one taking the traditional 2% management fee and 20% performance fee versus another using Firinne’s FLDA structure charging 2% and 20% with a market benchmark, with both structures employing a highwater mark. The portfolio initially consists of an illustrative 80% bitcoin, 20% ether weighting starting at the end of 2015 with $10,000 invested. Running the portfolio forward to the present day, both funds generated spectacular returns: $5.5MM for Firinne and $4.5MM for the competitor or in excess of 46000% for the investor, however the competitor has generated nearly $1MM less for their investors, due to a higher fee extraction and less return compounding due to the resulting smaller capital account. The breakdown of this discrepancy is shown in the second graph below. Ultimately, an investor would have paid $150,000 more in fees for a 15% worse performance to Firinne’s competitor over the years shown below. So clearly choosing an investor friendly fee structure can have a dramatic impact on an investor’s outcome.

The importance of active management

Of course, most investors at this point have heard of Bitcoin and Ethereum. Furthermore, many too would be able to find means of acquiring passive exposure to these assets, thereby cheaply replicating the above portfolio. However, where they once dominated the market of the entire digital assets space, the two largest digital assets now account for less than 60% of the entire market cap, and their share is dropping rapidly. For many, while they may be somewhat aware that great opportunities lie beyond the shallows of the Bitcoin and Ethereum, venturing out into the deep is a daunting prospect fraught with unknown hazards. However, neglecting the markets beyond “top two” is passing on considerable upside.

The decline of bitcoin dominance in digital assets marketcap. Source: coinmarketcap.com

Number of digital assets achieving a given market cap rank

Although digital assets market caps currently exhibit a power law distribution, we envisage a multi-chain future, where use case specific purpose built blockchains will interoperate and the landscape may look very different from the present. For example, capitalizing on the current network congestion on Ethereum due to scaling difficulties, a basket of alternative smart contract platforms, commonly referred to as alt-L1s (alternative Layer 1s) consisting of Solana, Avalanche, Luna and Algorand on Jan 1st 2021 to Dec 31st 2021, outperformed a market weighted portfolio of bitcoin and ether by multiples. Given the technological uncertainty, volatility and even custodial difficulties, for institutional investors willing to explore the markets beyond the two best known digital assets, employing an active manager probably makes a lot of sense. The Firinne Liquid Digital Assets fund is a highly cost-effective means to acquire exposure to the broader, rapidly expanding digital assets markets beyond just the most familiar assets.

How inefficient are the digital assets markets?

Names of digital assets attaining a first, second or third rank by market cap

In order to understand the value active management can bring to the investor, it helps to gauge the inefficiency of the digital assets markets. The mainstream of finance, late to the party and waiting on regulatory certainty and familiar tradable instruments, has largely observed from the sidelines these past two years as the market has grown 10x in value mostly on the back of retail interest. Whilst this has been a boon for retail investors, who for the first time ever managed to get in en masse on an investment opportunity ahead of the professionals, the downside of this euphoria is that many of these early investors will or have already fallen prey to the many unrealistic project valuations, and in some cases – outright scams, which proliferate the space. The absence of sophisticated market participants to thin the herd has created a market where valuations, often in the 10s of billions, are buoyed on the hopes and dreams of retail enthusiasm with little bearing on the fundamentals of a project or any connection to the realities of the underlying technology.

Sadly, for those piling in on the gold rush the probability of any given project plunging precipitously out of the set of top projects by market cap is dangerously high. In fact, if we were to count the number of projects that have occupied a top 40 position, as ranked by market cap since 2013, 288 projects would have placed. The current median ranking of this collection of projects is now outside of the Top 100. The two tables and the graph below highlight the ephemeral nature of market cap rankings in the crypto markets. The crypto markets are fickle and exhibit an extraordinary degree of churn and a sharp power law distribution relative to traditional equity markets. Examining even projects that were once considered among the top three projects in crypto, reveals many dead and failed projects after only a few years.

The graph below illustrates this message, of just how quickly assets feted as amongst the best in crypto can suddenly fall from grace. Not even to mention the ICO (Initial Coin Offering) bubble of 2017, where >99% of all ICOs failed, taking billions from investors. Nevertheless, set against the backdrop of capital destruction are vast returns accrued to those who make the correct investment decisions. The return on ether since its ICO in 2014 exceed 10,000%

Change in marketcap rank (relative to bitcoin) of prominent early projects over time

Any discussion on market efficiency is further complicated by the fact that determination of the true market cap of digital assets is, at times, far from obvious. Mining inflation schedules are things which can in principle can change according to community consensus thus making terminal market caps a somewhat uncertain number. Moreover, many units of common digital assets are suspected lost. Bitcoin, which would be the dominant constituent of any market cap weighted index, has an estimated 20% of all supply presumed lost forever. Surprisingly, this information is not typically incorporated into the weighting of a marketcap based indices.

This poses a difficulty for determining what is the true relative market weighting of any given asset in a crypto index. For instance, the ultimate maximum supply of bitcoin is algorithmically predetermined to be 21,000,000. However, uniquely for digital assets, on chain data can be used to gain insights unavailable in traditional markets helping inform opinions on asset dormancy or loss.

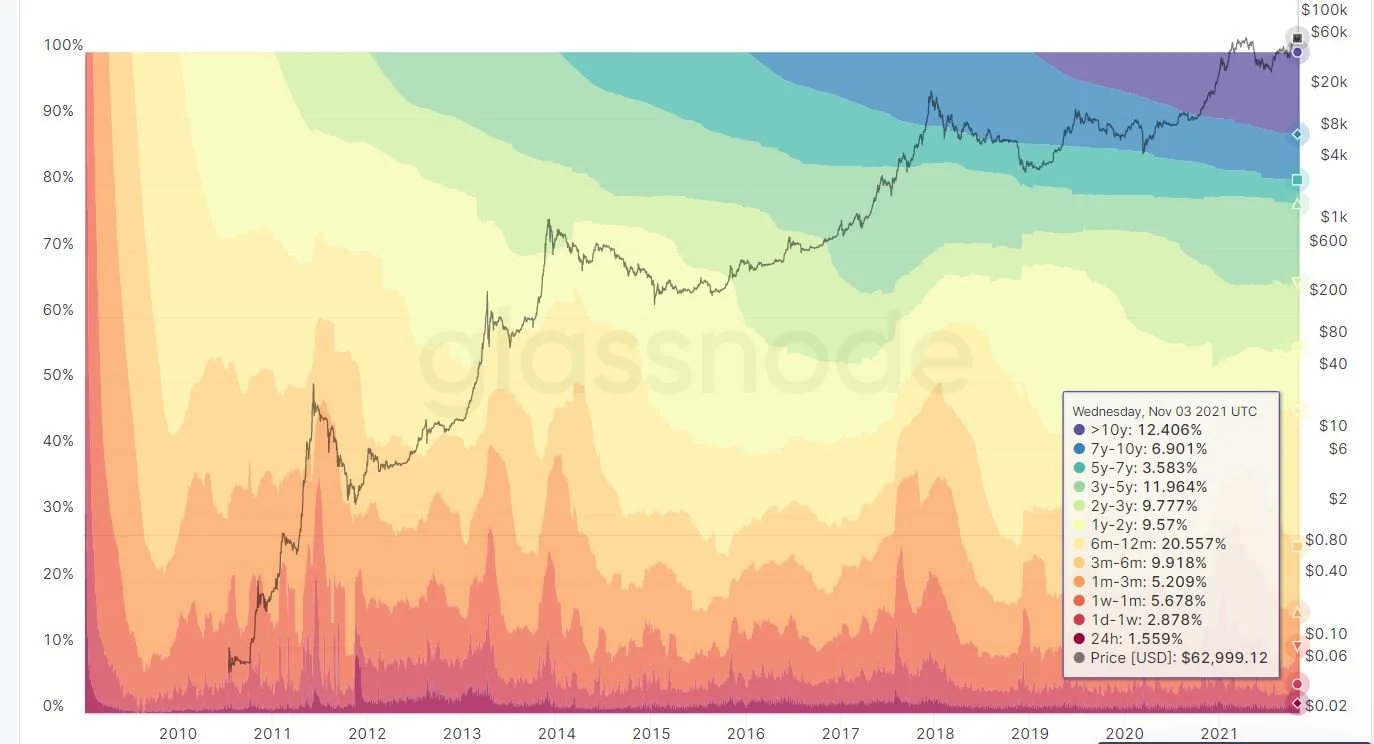

The chart below plots bitcoin “Hodl” waves from data available on the bitcoin blockchain. The black line plots the price of bitcoin on a log scale since creation. The various colored bands depict the time since a portion of all bitcoins have last moved from an address. Given the low valuation of bitcoin in the years following its creation, and the ease at which an address holder might lose track of their private keys, it is logical to conclude that a large percentage of bitcoins which have not moved in ten years, despite massive price appreciation, are probably lost permanently.

Bitcoin ”Hodl” waves. Source glassnode.com

All Digital Asset investments are active

Moving beyond the lack of consensus on the true marketcap of any given digital asset, even the act of holding a particular asset requires a degree of awareness regarding its development and community at a level uncommon in traditional markets. Even relatively passive holding of assets can force active decision making on investors. For example, changes in “inflation rates” by modifications to mining issuance rates, such as the upcoming migration of Ethereum from Proof of Work consensus to Proof of Stake consensus, may require investors to participate in staking activities to counter the effects of mining/validation inflation. Or so-called “governance token” assets may demand an investor participate in voting activities to retain ownership. Other examples include contentious forks, where the consensus on the true history of a blockchain ledger is called into question. What typically happens in these cases is that the community using the chains splits into rival camps, each supporting a different chain with a different accepted version of history. Both Ethereum and Bitcoin have suffered contentious forks over their lifetimes.

Below we plot the performance of these forks against what are now largely considered the “canonical version” of these chains. Of course, what would come to be considered canonical could not be known a priori. In general, these noncanonical forks have performed abysmally, however at the time of forking for many investors who were not specialists in these markets the outcome was far from obvious.

Ratio of Ethereum Classic marketcap to Ethereum

Ratio of prominent bitcoin forks marketcap to bitcoin

Amusingly, as a final comment on market inefficiency and exuberance, below is a plot of price impact of Elon Musk’s tweets about the memecoin Dogecoin. Whilst it’s not beyond the bounds of possibility that a dog-faced coin created as a joke might one day become the de facto Martian currency, clearly the market still hasn’t made up its mind on the matter.

Our Investment Philosophy

So given all of the above, how does an investor make money in such turbulent markets? Looking back over the course of several years, despite massive growth in the sector, surprisingly few people managed to invest successfully in digital assets. The root cause of this failure becomes readily apparent when looking at the enormous volatility and 90% drawdowns that investors would have had to endure. There is, however, a bright dividing line between those who invested successfully and those who did not – and that line marks the difference between those with a genuine belief in the promise of decentralization and the value of the user owned networks now forming the primitives of Web3, and those chasing the latest trends. The underlying technology of blockchain, after all, is nothing new, most of it having existed for several decades. What is truly innovative is the novel assemblage of existing technologies with the purpose of removing centralized intermediaries. Over the years many projects have violated this precept for short term gains to their long-term detriment. However, we believe that it is those projects and investors that have grasped the significance of decentralization, armed with the courage of their convictions that will ultimately prevail.

And, as exciting as it may be, witnessing the birth of a new asset class, with digital assets there is something more here, something profoundly different compared to traditional assets which drive our sense of purpose at Firinne Capital. With digital assets, we hold the seeds of a new world economy, one with the potential to transform the very act of human to human and human to machine transaction in ways that empower the individual that was never possible before. But we must tread carefully as we explore this new world. Here the story of this technology is still being written and there will be fortunes made and lost along the way. The uncertainties are real and many of the dangers are still unknown but with the right guide there is a wealth of opportunity for those willing to brave this new frontier.